- Home

- Portugal

Portugal Residence by Investment Program

Portugal golden visa program - Apply for Portugal residency by investment

OVERVIEW

What is Portugal’s residency by investing program?

The Portugal Golden Visa is one of Europe’s most popular residency by investment programs designed for non-EU citizens. It was launched in 2012 by the Portuguese Government and the program has since approved over 10,000 visas. The Portugal program is one of the gold standards for Golden Visa programs.

At the end of five years of the golden visa program living with a temporary residence permit, you are eligible to apply to become a permanent resident through a permanent residence permit. In addition, one of its most attractive qualities is its pathway to citizenship after just five years of residency.

Why Portugal residency might work for you?

It is a very flexible program with many options to choose from, as far as investments go. This could potentially make it the perfect residency program for you and your family! The benefits include the right to life and work in Portugal, with a high quality of life and access to healthcare system and education system.

- Portugal offers excellent connectivity to Europe and the United States

You can potentially qualify for a ten-year tax exemption on all “non tax haven” income - You can obtain Portugal citizenship (and by extension, EU citizenship) after six years

- Portugal’s passport is a US Visa Waiver passport

Interested in a Portugal golden visa? JH Marlin can help you!

Main Advantages for Portugal Residency Visa Program

Visa Free Travel

- The Portuguese residence permit also registers you in the Schengen area, which means that you have freedom of movement within European countries, including the United Kingdom

- If you apply for Portuguese citizenship at the end of five years of residency, you can get a Portuguese passport and European citizenship, allowing you to travel visa-free or visa-on-travel to over 185 countries

Business Advantages

- The Portuguese residency permit allows you to live, work, and study in Portugal

- The work permit allows you to work and start your own business in Portugal

- As a Portuguese resident through the investment program, you will not be taxed unless you spend more than half the year (183 days) in Portugal. Even then, Portugal has a favourable tax scheme for foreigners.

Family Advantages

- The main applicant may include their family in their visa application, including their spouse, children under 18, dependent children under 26 (provided they are unmarried, full-time students, and financially dependent), and parents over 65.

PERSONAL FREEDOM

- After 5 years of residency, you may apply for citizenship in Portugal and become a Portuguese citizen and get a Portuguese Passport

- Portugal allows dual citizenship

- Full access to renowned healthcare and educational systems in Portugal

- No restrictions on nationality outside of EU

Requirements for a Portugal Residency Visa Application

- Applicant must be at least 18 years old

- Applicant must have a clean criminal record from home country and from Portugal

- Applicant must have medical insurance valid in Portugal

- Applicant must have funds for the investment (from outside of Portugal)

- Applicant must commit to maintaining the investment for at least another five years

The different routes to Portugal Residency Visa

Portugal offers several investment options to achieve their Golden Visa Program. These include:

Residency through Real Estate Acquisition

- Most popular option

- Minimum real estate purchase (residential or commercial property) of €500,000

- However, if purchased in a low-density area, the minimum investment is €400,000

- Minimum real estate investment of €350,000, either for refurbishment in a residential property older than 30 years, or in a Portuguese urban regeneration area.

- However, if purchased in a low-density area, the minimum investment is €280,000

- Note that starting in 2022, purchasing real estate in Lisbon, Porto, Algarve, Setubal or popular coastal areas, will not qualify for a residency permit, as Portugal is attempting to increase investments to previously neglected low-density areas.

Fund Subscription

- A minimum of €500,000 subscription in a qualifying Portuguese fund.

Capital Transfer

- Capital transfer of a minimum of €1.5 million into a bank or other approved investment in Portugal

Company

- Creation of at least 10 new full-time jobs in a Portuguese business owned by the main applicant

- If business is formed in a low-density area, only 8 new jobs are required

- Minimum investment of €500,000 in an existing and registered business in Portugal. The business must create a minimum of five new full-time jobs for at least three years.

Donation

- Invest a minimum of €250,000 in preserving national heritage in Portugal, or in supporting artistic production

- Minimum investment of €200,000 in a low population density area

- Invest a minimum of €500,000 in a research and development activity in public or private entities in Portugal that are part of the national scientific and technological system

- Minimum investment of €400,000 in a low population density area

What is the procedure for a Residency Visa Application in Portugal?

One can expect that the application process for residency in Portugal to include the following:

- Clients contact JH Marlin

- Initial due diligence checks are performed to determine eligibility

- Client agreement is signed, and retainer is paid

- Applicants choose the qualifying investment option best suited to them

- A comprehensive list of documents will be provided. Files are prepared and required documents are collected

- Applicants open a bank account and get a NIF

- Qualifying investment is finalized by applicant

- Pre-application and corresponding documents submitted to the SEF

- After about two months, SEF provides appointment for biometrics

- After about four months, residency cards are issued (valid for two years before renewal)

- After five years, applicant is eligible to apply for citizenship in Portugal

All the investments have to be made through the Portuguese bank account, so the first thing to do is create the tax number and open a bank account (which can be done remotely).

Tax number creation and bank account opening

To prepare the Power of Attorney and open the bank account remotely you will need to provide:

- A quality copy of Passport picture and signature page

- A proof of address (utility bill, electricity, water, phone, bank statement)

- A proof of profession (employer declaration, self-employment certificate, etc.) – issued less than three months

- Three last salary receipts (with professional position/category)

- Annual income statement (if applicable)

- Bank statements of all accounts

- Ownership of Real Estate worldwide (if applicable)

- Foreign tax number or equivalent (ID number from residence country)

Email and phone number mobile (for the bank to contact directly)

Once the bank account is opened and you have decided which investment route you will chose, you will have to transfer the funds, for the investment, to the Portuguese bank account.

The investment option can be chosen in Portugal or abroad remotely. If you choose to do it remotely, you only need to come to Portugal for the biometrics at SEF and deliver the originals of the documents submitted online.

Documents Required for Portugal Residency Visa Application

- Certified copy of valid passport

- Two passport-sized pictures

- Proof of qualifying investment (ie. deed, proof of deposit)

- Declaration from Portuguese bank confirming transfer of funds

- Proof of health insurance from internationally covered insurance company

- Proof of no criminal record: criminal record certificate from country of residence (under three months from submission)

- Authorization form for SEF to access criminal records in Portugal

- Sworn declaration to comply with minimum investment requirements for at least five years

- Documents attesting to compliance with Portuguese Tax and Customs Authority & Social Security system (under 45 days from submission)

- Receipt of residency application payment

Note: A detailed list of document requirements and sample documents will be provided once you become

FAQ

Frequently Asked Questions

Who in my family can benefit from my residence visa?

The main applicant’s spouse, minor children, dependent children, and dependent parents also obtain a residence permit through family reunification.

How much does the Portuguese residency visa cost?

The cost of the Golden Visa depends on the investment route that is chosen. On top of the investment, there are acquisition costs, legal costs, and government application fees.

How long is the processing time for a residency visa in Portugal?

Typically, it takes approximately six to eight months to receive your residence card.

Should all supporting documents be translated to Portuguese?

Documents to the Portugal Residence by Investment program need to be translated into Portuguese or English.

Can I do the Portugal Residence by Investment program on my own?

Yes. However, because the process is effort-intensive, there is hefty documentation required, and you’ll be making a significant investment it is highly recommended that you use a professional advisor and a legal representative in pursuing the program.

What is Portugal's taxation scheme?

Having a residence visa in Portugal doesn’t automatically make you a tax resident of Portugal. If the investor does not spend 183 days or more in Portugal within a year, the investor is not a tax resident.

Your income within Portugal, must be declared in Portugal and you will be taxed on it. Due to possible Double Taxation Treaties, you will not be taxed multiple times on the same income.

What is the cost of living in Portugal?

Portugal has a low cost of living compared to the rest of Europe.

Do I need to reside in Portugal?

Portugal doesn’t require you to live in the country full time. The minimum physical presence requirement is only seven days per year in Portugal. Besides that, you may live in your country of origin or any other place worldwide. However, if you are pursuing citizenship you will need to meet minimum stay requirements.

Can I use cryptocurrency to apply for the Portugal Residence Visa?

The Portuguese government does not accept the residence investment to be made in cryptocurrency or any other currency other than Euros.

What are the investment options for a Residence Visa in Portugal?

The Portugal Residence by Investment program provides several routes including: real estate acquisition, transfer of capital, creation of 10 jobs, and financial support in national activities in Portugal. You may find the specifics of each route above in this article.

How long does it take before I can apply for Portuguese citizenship?

You are eligible to apply for citizenship in Portugal at the end of your fifth year as a Portuguese resident. Once you are naturalized as a citizen, you can then obtain your passport.

Does Portugal allow dual citizenship?

Yes. Portugal allows for dual citizenship.

Do I need a language test for the Portugal Residence by Investment program?

No, you do not need to pass a language test in order to qualify for residency in Portugal. A language test only applies if you decide to become a permanent resident or citizen after five years.

How long is the Golden Visa valid for?

The first residence card is valid for a two-year period, in which you should satisfy 14 days of physical requirement. Following this, you can renew your visa residence card which will each be valid for three years at a time. Within each of these three-year periods, you must spend at least twenty-one days in Portugal. Renewals are unlimited, as long as your investment is maintained. *minimum physical presence requirements may vary

What countries are included in the Schengen area?

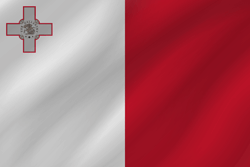

Schengen area countries include Austria, Belgium, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Netherlands, Norway, Poland, Portugal, Slovakia, Slovenia, Spain, Sweden, and Switzerland.

What happens to the investment after five years?

At the end of five years as a legal resident, you have three options as a Golden Visa holder: to continue with temporary residency, to become a permanent resident, or to become a Portuguese citizen. If you choose to become a permanent resident or a Portuguese citizen, you can then sell or liquidate your investment. However if you continue with the temporary residency by investment program, you must keep your investment.

Does the investor need to use the property they purchase?

No, the investor is not required to live in or use the real estate they invest in. It can be rented out or used as the investor wishes.

What is the most common investment route for Portugal?

The most popular route for the Golden Visa Portugal is real estate investment

Why Portugal residency might work for you?

- Portugal offers excellent connectivity to Europe and the United States

You can potentially qualify for a ten-year tax exemption on all “non tax haven” income - You can obtain Portugal citizenship (and by extension, EU citizenship) after six years

- Portugal’s passport is a US Visa Waiver passport

Portugal: General Information

Part of the European Union and one of the oldest countries in Europe, Portugal is full of rich history and diverse culture. Its proximity to the Mediterranean, with warm weather and warmer people, makes it the perfect destination for foreigners and their families to relocate. The landscapes, including rolling hills, refreshing coastlines, blue-and-white tiled architecture, is all part of its charm. It also boasts a high quality of living, low cost of living, low crime rate, and tax exemptions for residents. Foreign nationals find Portugal especially lucrative due to its secure and quickly-growing market and often make the move for tax purposes.

Fast Facts:

Location: 39° N & 8° W | Iberian Peninsula, Southwestern Europe

Capital: Lisbon

Size: 92,212 km2

Population: 10.1 million

Currency: Euro

Government: Democratic Parliamentary | Republic

Economy: Service-Based | Financial Services | Tourism

Language: Portuguese

Religion: Roman Catholic

Ongoing Maintenance:

Here are some other important aspects to note:

Once the Residence Card is obtained, it is valid for five years, and there is the possibility to be apply for a permanent residence permit after five years and for Portuguese citizenship after six years of holding legal residency and by proving ties to the country.

Once you are a resident of Portugal, you may travel freely throughout the European Union; we recommend keeping a spreadsheet to document where you are each day for tax purposes.

From the tax side, Portugal has a special non-habitual residence regime. The non-habitual resident (NHR) regime is open to anyone having the right to reside in Portugal who has not been a tax resident of the country during the previous five years.

This regime grants a new resident of Portugal a ten year tax exemption on most non-Portugal-sourced types of income, whether or not they are taxed at source, and whether or not, under a double taxation agreement (DTA), tax at source is reduced (e.g. on dividends, interest or royalties) or even eliminated (e.g. on pension income derived from private sector employment). However, some types of income, such as capital gains from the disposal of securities (shares, bonds, etc) are not directly exempt from Portuguese tax and, if significant, do require some prior tax planning.