Obtaining residency in a zero-tax country can have several advantages. Advantages include, the potential to legally reduce your overall tax burden, a better quality of life amongst other advantages. This article will outline some of the top tax-free countries in the Caribbean. There are large numbers of tax-free countries in the Caribbean, offering many opportunities to find a low-tax country that meets your unique needs. Below are several countries that offer attractive tax structures:

Anguilla

Anguilla has a High Value residency program where investors can either qualify by making an investment in a Capital Development Fund starting at US$150,000 or direct into Real Estate with a minimum investment of US$750,000 (the property needs to be maintained for a minimum of 5 years). Anguilla is not a well known island but has some of the best beaches in the world. There is no direct taxation, no income tax, capital gains tax, gift tax, net worth tax, inheritance tax in the country.

Antigua & Barbuda

Antigua & Barbuda is a country that offers a citizenship by investment program. By either making a donation to the country or investing in government approved real estate you can become a citizen of the country in around 6 months. Antigua & Barbuda citizenship program has grown in popularity; there is no personal income tax, capital gains tax, gift tax, net worth tax, inheritance tax in the country. Many businesses locally accept bitcoin cash as a form of payment attracting cryptocurrency investors from around the world.

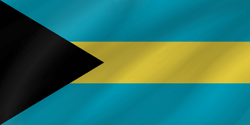

The Bahamas

The Bahamas is a traditional no tax jurisdiction. Many people from the US decide to relocate to the Bahamas in the Lyford Cay area or other islands in the Bahamas. Bahamas residency program requires significant local investment, but you can also take advantage of living in a tropical paradise for that investment. The Bahamas’ economically friendly non-resident tax laws have driven significant growth in the Bahamas financial markets. The minimum investment starts at over US$500,000.

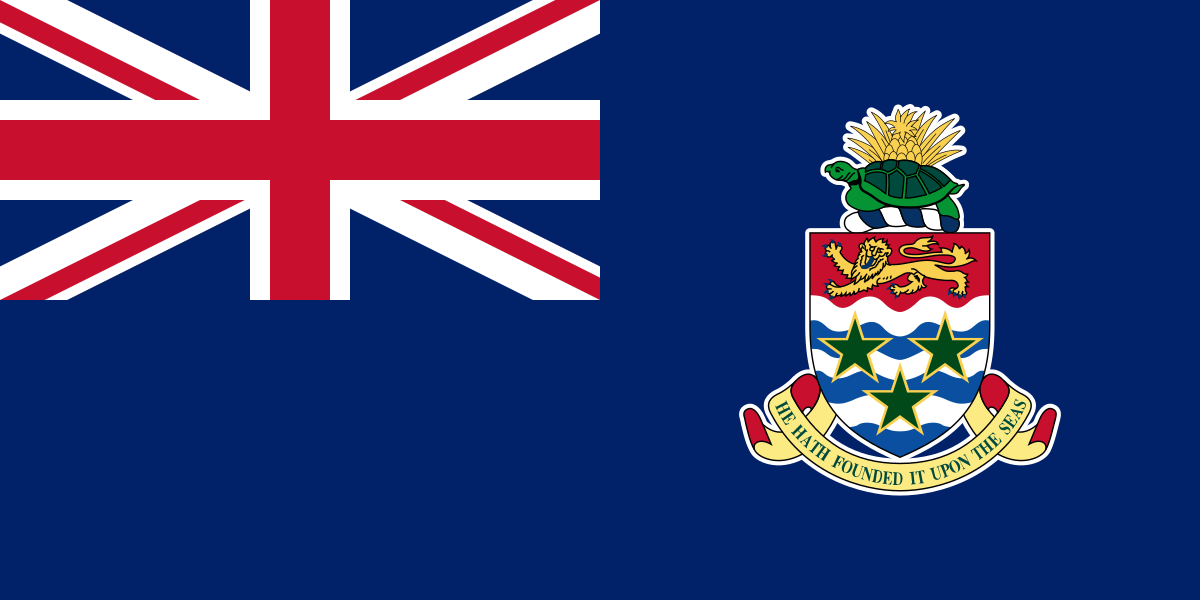

Cayman Islands

The easily accessible Caribbean paradise has many business and recreational pros. The Cayman Islands is one of the best funds jurisdictions in the world with a reputation for being a well-regulated, tax-neutral financial hub. The country attracts significant international financial and real estate investors. Those looking to secure permanent residency have multiple possible routes, such as Residency by Independent Means, Residence by Substantial Business Presence, Certificate of Direct Investment, and many others. Costs and requirements for investments differ for each option; therefore, it is important to consult before taking a decision. The cost of Cayman residency is significantly higher than other residency programs but the quality of life and large expat community does not compare.

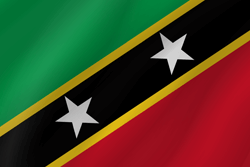

St.Kitts & Nevis

St.Kitts & Nevis is one of the most popular countries that offers citizenship by investment. The people are very welcoming and it is a laid back relaxed lifestyle. The St.Kitts & Nevis Citizenship by investment program is one of the most family friendly programs and is the most affordable for people looking to expand their families. St.Kitts & Nevis is a tax neutral country with no personal income tax, wealth, gift inheritance tax. Well known celebrities often come on vacation to relax.

This article just mentions some of the countries but there are many other options like Bermuda, St.Barts and others that have a high quality of life and are a great place to spend time. JH Marlin’s team have lived or visited almost every Caribbean country and can provide insight and comparisons between the different Caribbean islands and what they have to offer.