Citizenship by investment programs have become a popular avenue for individuals who seek to broaden their horizons and expand their opportunities in today’s globalized world. However, with the allure of a new passport and citizenship status comes a web of potential tax implications that must be carefully navigated.

The Tax Implications of Citizenship by Investment Programs

Tax Residency Status

Tax residency status refers to an individual’s or entity’s classification by a country for tax purposes. It determines the extent of their tax obligations in that particular jurisdiction. Different countries have their own criteria for determining tax residency, and these criteria may include factors such as the amount of time spent in the country, the individual’s permanent address, or the location of significant economic interests.

One of the first considerations for individuals pursuing a citizenship via investment program is the determination of tax residency status. Since different countries have distinct criteria for classifying residents, this status can significantly impact the tax obligations of new citizens.

Citizenship Benefits vs. Tax Liabilities

While the benefits of new citizenship are evident, understanding the associated tax liabilities is crucial. From personal income tax rates to capital gains and estate taxes, each aspect demands attention. Jurisdictions may have varying approaches to taxing individuals with dual citizenship, creating a complex landscape that necessitates careful examination.

Engaging an experienced attorney is a prudent step in navigating the intricate relationship between citizenship benefits and tax liabilities. Attorneys specializing in citizenship possess a deep understanding of the legal nuances involved. They are well-versed in the tax laws of different jurisdictions, enabling them to provide accurate and tailored advice on potential liabilities.

Key Components of CBI Tax Implications

CBI programs typically require foreign investors to make substantial capital investments, whether through direct contributions to a national development fund, investment in government-approved projects, or other financial commitments. Understanding the tax implications of these investments is a critical component of the overall process.

- Tax Treatment of Investments: Different jurisdictions have varying tax treatments for specific types of investments. A CBI attorney with expertise in tax law can provide insights into how the chosen investment may impact an individual’s tax liability.

- Reporting Requirements: Compliance with tax laws involves accurate and timely reporting of financial transactions. Understanding the reporting obligations associated with capital investments ensures that applicants fulfill their responsibilities and avoid penalties.

- Tax Incentives: Some countries offer tax incentives or exemptions for certain types of investments. An attorney can help you identify opportunities to optimize the tax benefits associated with your chosen investment route.

Source of Funds and Financial Institutions

The origin of funds is closely scrutinized to ensure legitimacy and prevent illicit financial activities. Financial institutions play a pivotal role in this process, and compliance with tax laws is paramount. Attorneys specializing in citizenship guide applicants in conducting a thorough due diligence check on the source of funds. This not only ensures compliance but also safeguards against potential legal issues. Given the global focus on preventing money laundering, compliance with regulations is crucial. Attorneys can guide you on meeting AML requirements and establishing a transparent financial trail.

Real Estate Investments and Estate Taxes:

For those choosing real estate as their investment avenue, navigating the estate tax landscape is a crucial aspect of the citizenship by investment journey.

- Government-Approved Projects: Understanding which real estate projects are approved by the government is vital. Attorneys can guide citizenship by investment applicants in selecting projects that align with both citizenship requirements and tax implications.

- Estate Tax Planning: Real estate holdings may be subject to estate taxes. Attorneys specializing in tax law can assist in developing strategies to minimize estate tax liabilities, ensuring a smooth transfer of assets to heirs.

- Tax Incentives for Real Estate: Some jurisdictions offer tax incentives for real estate investors. Attorneys can identify and leverage these incentives, optimizing the overall financial impact of the chosen investment path.

How Does Citizenship by Investment Work?

Global Perspectives: Citizenship by Investment Programs Around the World

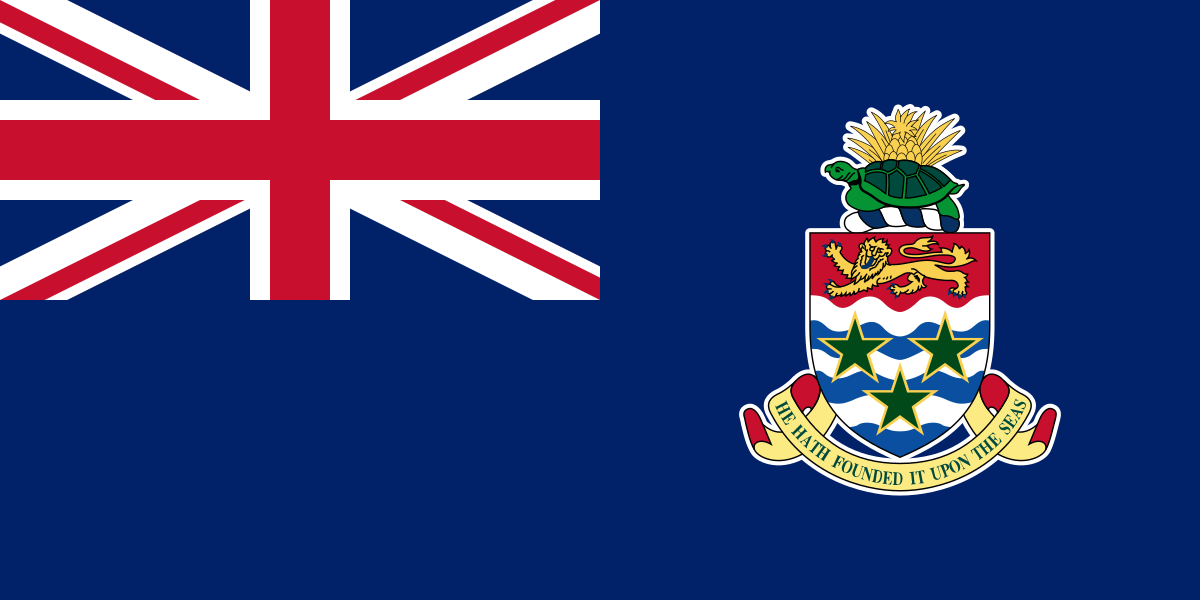

Different regions offer diverse citizenship via investment programs. Caribbean nations, for example, have very distinct tax treatments from European countries. Foreign nationals interested in a dual citizenship option with beneficial tax treatment often gravitate toward the following CBI programs:

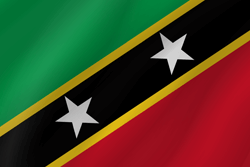

St. Kitts and Nevis

St. Kitts and Nevis pioneered the concept of citizenship by investment in 1984. Applicants enjoy a wide range of investment options, including the opportunity to contribute to the Sustainable Island State Contribution (replaced the Sustainable Growth Fund) or an investment in approved real estate projects. This program offers visa-free or visa-on-arrival access to over 150 countries.

Antigua and Barbuda

Antigua and Barbuda’s CBI program is known for its flexibility. The program offers investments in the National Development Fund, real estate, or business. Additionally, it allows family members to be included in the application.

Dominica

Dominica’s CBI program is one of the oldest and most affordable Caribbean programs. Acquiring Dominican citizenship normally involves a contribution to the Economic Diversification Fund or an investment in approved real estate. It offers a fast method for economic citizenship with a straightforward and efficient application process

Grenada

Grenada’s program is known for its E-2 visa treaty with the United States, which allows successful applicants to apply for the U.S. E-2 non-immigrant visa. This route to citizenship usually requires contributions to the National Transformation Fund or investments in government-approved projects.

St. Lucia

St. Lucia’s CBI program emphasizes sustainable development. Its investment options involve contributions to the National Economic Fund, investments in approved real estate, or a donation to the Saint Lucia Sovereign Fund. This foreign investment option promises a relatively quick processing time.

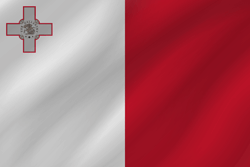

Malta

Malta’s program is known as the Individual Investor Program (IIP), which grants access to European Union citizenship. Its investment options include a contribution to the National Development and Social Fund, investments, and residency commitment.

Why Americans Are Choosing Dual Citizenship by Investment in Malta

Turkey

Turkey offers a citizenship program for investors, providing a gateway between Europe and the Middle East. This citizenship through investment route requires a significant financial commitment, such as real estate investment or the creation of new job opportunities in the country.

Vanuatu

Vanuatu’s program is one of the fastest-growing in the Pacific region. It requires applicants to make a financial contribution to the Vanuatu Development Support Program. This program is particularly notable for its efficient processing, making it an appealing choice for individuals seeking a swift route to acquiring citizenship.

Apply for Citizenship by Investment

JH Marlin Law is the ideal partner for those seeking a strategic approach to citizenship by investment. With a remarkable nearly 100% success rate, our firm has guided clients from over 45 countries through the intricacies of acquiring a second passport. Our services extend beyond citizenship by investment, encompassing residency by investment, corporate commercial law, and real estate expertise, providing a comprehensive suite of solutions for individuals looking to establish a robust action plan.

As trusted advisors, we assist clients in creating holistic offshore plans that not only encompass citizenship but also integrate lifestyle planning, residency, and tax optimization strategies. The firm’s dedication to maintaining confidentiality, coupled with testimonials from top entrepreneurs, underscores our commitment to delivering results.

Frequently Asked Questions

Note that obtaining a second passport does not automatically change your tax status.

How does obtaining citizenship impact my taxation status?

Acquiring citizenship can potentially have implications on your tax obligations, influencing factors such as residency status, capital gains, and inheritance tax provided you relocate to your country of citizenship and become a non-resident of your home country. It’s essential to understand the tax landscape of both your current country of residence and your newly acquired citizenship.

What are the taxation considerations for dual citizens?

Dual citizens navigate a complex tax environment, as different countries have varied approaches to taxing individuals with dual citizenship. Understanding the tax laws of both countries is crucial to ensure compliance and optimize your financial position.

Can I maintain tax residency in my home country while holding citizenship elsewhere?

Yes, it is possible. Tax residency is determined by various factors, and holding citizenship in one country does not necessarily override your tax residency status in another. Consulting with legal experts can help you navigate dual tax obligations.

Are there specific taxes on assets for citizens of a foreign country?

Taxation on assets can depend on different factors. Some nations may impose taxes on worldwide assets, including those held abroad. Understanding these regulations is crucial to managing your wealth effectively.

How does citizenship impact my rights in terms of residence and ordinary income?

Citizenship often grants rights to reside in the country and access ordinary income streams. However, taxation on this income can vary, and understanding the rights and obligations associated with your citizenship is essential for informed decision-making.

Is there a route to citizenship through direct investment, and how does it affect taxation?

Many countries offer citizenship by investment programs involving direct investments. While this can expedite the citizenship process, it’s vital to comprehend the associated tax implications, such as capital gains and eligibility criteria for these programs.

Can I be a tax resident in a country without holding its citizenship?

Yes, it is possible. Tax residency is determined by factors like the duration of stay and economic ties to a country, independent of citizenship. Being a tax resident can entail certain obligations, even without holding citizenship.

What are the tax implications of holding passports from multiple countries?

Owning passports from multiple countries can potentially affect your tax liabilities. Each country may have its taxation rules for citizens or its residents, and understanding these implications is crucial to managing your financial responsibilities.

How can I assess my eligibility criteria for citizenship and its tax implications?

Eligibility criteria for citizenship through investment routes vary between countries. Consulting with legal professionals can help you assess your eligibility and understand the potential tax implications associated with acquiring citizenship.

Please note that this article is for informational purposes only and does not constitute legal or tax advice. Each individual’s circumstances are unique, and for advice specific to your situation it is important to consult with a qualified lawyer.