When most people think of offshore asset protection, they think of opening an offshore bank account. However, this is not your only option. In fact, trusts are the ideal and virtually impenetrable option for those seeking offshore asset planning or international tax planning. However, it requires a more complex structure to set up. There may also be tax advantages to establishing a trust structure.

What is a Trust?

Trust law has a bad rap for being complex due to the fact that most people do not understand them, and because laws on trusts do not exist in many areas of the world. This begs the question, what exactly is a trust?

Unlike a corporation, a trust is not a separate legal entity. Think of it more as the relationship between a person and their assets. Normally, ownership, benefit, and control are synonymous when it comes to asset-owning. However, trusts are a mechanism for separating these concepts.

How does a trust function?

A trust functions with three parties:

- The grantor is the person who sets up the trust;

- A trustee functions as the owner of the assets, legally managing them;

- The beneficiary (or multiple beneficiaries) reaps the benefits of the assets;

These relationships are dictated by a trust deed, which lays out the roles of each party and operation of the trust’s assets. However, these relationships can get complicated. The grantor may also be the beneficiary, or the trustee. Third parties can be named as a trustee if they exercise powers of the role.

H5: Trust companies are legal entities that act as the trustee or business, to aid in the management, administration, and transfer of assets to the beneficiary, for a fee.

These trust companies do not own the assets, they only have the right to manage them, but they also shoulder a legal responsibility to do so in the best interest of the parties.

Asset Protection Trusts

Trusts are often used to manage inheritances, or to protect assets. In the latter case, this might include transferring funds into a trust to potentially protect assets from future lawsuits, or going through a divorce. In these cases, setting up a proper trust to prevent loss of assets is a good idea.

The trust is owned by a trustee, protecting your assets from potential lawsuits and creditors

Asset protection trusts are a special type of trust where you are the grantor and sole beneficiary of the trust. The trustee, as the sole third party, is assigned to protect your assets. Essentially, you maintain control of the assets, but they are owned by the trust on paper.

It should be noted that assets can be taken by creditors from the trust if the trust was created too recently to a lawsuit, as this would constitute a fraudulent transfer. Usually, the minimum threshold to protect assets without making what is considered a fraudulent transfer is two years before the asset was threatened.

Asset protection trusts also protect an inheritance

However, these trusts have secondary benefits beyond company asset protection. This protection also extends to personal assets. If you put personal funds into a trust, you technically do not own them anymore, so a creditor would have difficulty to pursue them.

Trusts can also be used to protect funds for your heirs so that the money is used for a specific purpose, such as education, healthcare, or business.

What are Offshore Asset Protection Trusts?

Most common law countries have some form of domestic trust, which is common for inheritance, estate protection or even asset protection. They can even be created without a formal trust deed. These are relatively straightforward.

An offshore trust is one where the trustee is not a resident of the country that the trust is located in. As a result, the trust is often taxed under the country it is held in, which is typically a tax haven. However, it would be important to ensure that all tax obligations around the world are met and that proper legal counsel is obtained in the country you are living in or where you are a citizen of (example United States).

Where it gets complicated is determining whether a given trust is domestic or offshore. In other words, what makes an offshore trust offshore? Is it whether the assets are located offshore, the beneficiaries are located abroad, or the trustee is in a foreign jurisdiction?

There are many components to trusts that must be considered before opening one

There are three main jurisdictions to consider with any trust.

- The first is the jurisdiction of registration. While some trusts are informal and will be held up in court, there are also registration lists the same way there are for corporations.

- Secondly, there are administration jurisdictions, which is where the trust is managed, or the powers of the trustee are exercised.

- Lastly, the jurisdiction of adjudication is where the laws governing the trust fall under in the event of dispute.

Due to this separation in jurisdiction, trusts can be multi-jurisdictional. Some countries, like Canada, have created laws where often the jurisdiction of registration dictates the jurisdiction of the trust as a whole (but not always). But this is not true everywhere. The bottom line being that trusts as a concept can be complicated or even misleading, especially when it comes to offshore jurisdictions.

What are the benefits of an offshore protection trust?

If trusts are so complicated, why are they so popular and powerful? This is because, quite simply, the very definition of a trust is that you, as the grantor or beneficiary, do not own the assets. It also means that your assets are hard to get at, from a creditor’s perspective. Moving your assets offshore means that there is a second legal system acting as a barrier that makes it harder for foreign court orders to be recognized.

This is also true for taxation. Most taxation schemes are based on ownership, but if you do not technically own the asset, this sometimes makes it hard to determine taxation. Trustees must also operate the trust in a way that maintains confidentiality. This is because it is difficult to access personal information as registries in offshore financial centers are not always publicly available, and there is in some jurisdictions a regulatory framework that prevent such information from being disclosed. It is important to ensure that you meet all tax obligations when establishing a trust and often tax legal counsel is required.

It is important to note that trusts are not a get-out-of-jail-free card and trust laws are created to prevent abuse or illegal activity. However, with proper planning, trusts do offer an opportunity to set up your finances in a way that you cannot do otherwise.

Different Countries – Different regulations and legislations

As stated, trusts come from common law, so while most common law countries have laws on trusts, a lot of countries across the world do not function through common law. Some of these countries recognize trust law in some form. Most commonly, these countries have signed the international treaty Hague Convention on the Applicability of Trusts and Their Recognition. This means that these jurisdictions recognize foreign trust law (between signatories). This is not exclusive to treaty signatories, however, as other countries have created laws to deal with foreign trusts.

Other countries, like the United Arab Emirates, explicitly state that they do not recognize trusts in local law. This actually makes such countries very powerful, as they do not have tax schemes to deal with trusts. Therefore, countries like Spain or France, which do not have trusts allow you to hold assets in trusts abroad and cannot always force you to bring the money back onshore to be taxed (however, it is important to hire proper tax counsel to advise on specifics). This means that while you may not be able to create a formal trust in this country, it does not prevent the grantor, trustee, or beneficiary from being located in these countries.

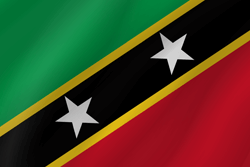

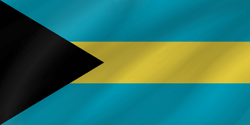

Common countries used to form trusts include Nevis, Cook Islands and Belize, as they all have strong protection regulations and legislation. However, other jurisdictions may be well-suited to your needs, depending on your distinctive circumstances. When deciding on a jurisdiction for offshore asset protection trusts, a specialized attorney is your best ally!

The Bottom Line

While other options exist to protect your assets, none have stood the test of time quite like offshore asset protection trusts. Although complex creatures, proper formation of an offshore asset protection trust that is located in the right foreign jurisdiction can optimize asset protection privacy, and tax benefits.

The options are vast, and a suitable jurisdiction for you may depend on your unique situation. Offshore asset protection trusts may be the perfect solution for you, but they must be set up ahead of time to avoid fraudulent transfers. For these reasons, it is important that you begin discussing your own custom asset protection plan with a professional.

You are considering opening an offshore asset protection trust? Contact JH Marlin Attorney at Law to discuss your objectives and your situation

* This article does not constitute legal, tax or financial advice. This article is for information purposes only and the information can be subject to change at any time.