Things move fast in 2024. Geopolitics and economics are shifting – in many ways, negatively.

The strategic investment in a second citizenship has become increasingly important for high-net-worth and ultra-high-net-worth individuals. To protect their families, to improve their lifestyle, and to diversify their assets.

In fact, JH Marlin has helped the most billionaires in the world invest in a second passport.

So what goes into this critical decision? What makes millionaires and billionaires devote their time and capital to a passport portfolio?

JH Marlin walks our client through a series of considerations to help them make the best investment possible for themselves, their families, and their future.

Below is our seven-factor comprehensive guide to considering a second passport:

Strategies for Selecting the Right Jurisdiction for Second Citizenship

Investing in a second passport is a big decision – and in some cases, irreversible. We dive into seven key factors you should consider before investing your time and capital in a second citizenship:

1. Lifestyle Preferences

Of course, investors and high-net-worth individuals must factor in their desired lifestyle when considering a second citizenship. After all, they want their new country to align with their personal preferences, general life direction, and long-term aspirations.

Here’s what we’d recommend factoring into your decision:

- Climate

- Language

- Travel access

- Quality of life

- Cuisine

These elements of a lifestyle significantly impact overall happiness and satisfaction. Just ask Dan Buettner, researcher of the world’s Blue Zones.

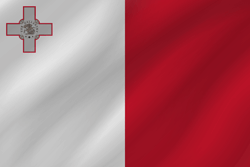

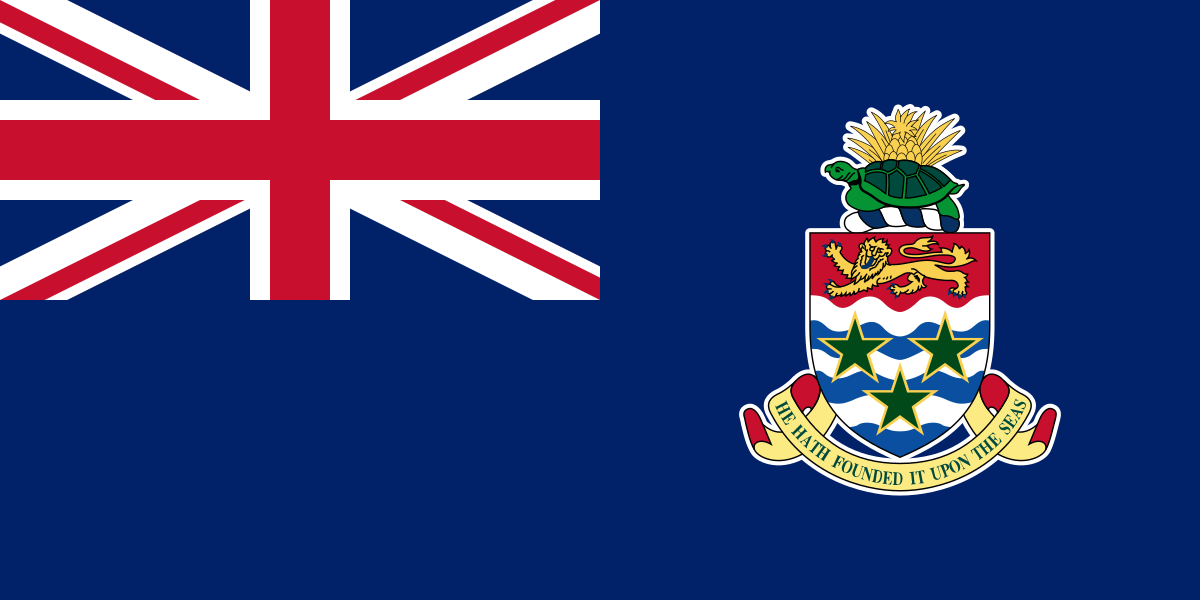

For instance, if you enjoy a tropical climate, outdoor activities, and a laid-back lifestyle, you would find island nations and friendly citizenship-by-investment programs like Antigua & Barbuda and Malta more appealing than those with a fast-paced urban environment.

Similarly, if you are accustomed to a luxury lifestyle with access to high-end amenities, countries known for their extremely high living standards, like Monaco or Singapore, would be more suitable for you.

It’s not just about the practical benefits of a second passport, such as mobility or tax advantages. You also want to enjoy life in your new country, especially if you will spend a significant amount of time there.

2. Business and Investment Opportunities

If you’re an entrepreneur and investor, you must factor in the business and investment opportunities when considering different citizenship programs.

Why? Your investment decision impacts how you …

- Expand your business

- Access new financial markets

- Leverage financial benefits exclusive to citizens

Different countries offer different business environments, investment incentives, and market opportunities, of course. This decision can significantly influence the direction of your professional growth – in a positive direction.

That’s why JH Marlin helps you align your choice of second citizenship with your business and investment goals.

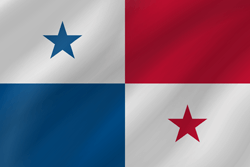

For example, a young entrepreneur may prefer a second citizenship in a country with a robust startup ecosystem and favorable tax incentives – like Panama.

3. Global Mobility

We advise high-net-worth individuals to consider to which regions of the world they want access. Travel freedom, particularly visa-free access, is a critical aspect of a citizenship investment decision.

If an individual invests in a second citizenship in a country that does not offer him the global access he requires for his business dealings and preferred lifestyle, that decision can negatively impact his both personal and professional life.

International movement is not just a matter of convenience. Visa-free access allows you to stroll into a country without having to spend days or weeks on visa applications, waiting periods, and interviews.

Enhanced mobility means higher quality and more ease of personal and business travel.

Ideally, a second citizenship significantly extends one’s mobility by giving them more **visa-free access to countries around the world.

While it may impact other factors, a second citizenship’s access that simply mirrors one’s first citizenship’s access is not an improvement from a global mobility standpoint.

JH Marlin has worked with several high-net-worth individuals from the Global South. Historically, most citizenships in the developing world do not have as great of global access as most Western countries.

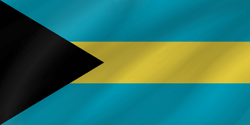

Therefore, we sometimes advise them to invest in a European Union member state like residency or citizenship programs in Portugal, Malta, Greece, or Cyprus. Once they have an EU-affiliated passport, their visa-free access around the world nearly doubles.

4. Family Considerations

If an investor has a family and children, they must consider the wellbeing and long-term goals of their loved ones.

Here are some factors that applicants should consider in a given citizenship program:

- Education quality

- Healthcare

- Safety

- Military obligation

- Living standards

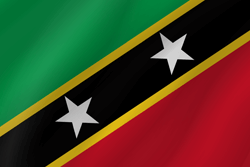

Some countries and programs offer whole families (age-depending for children), not just the main applicant, citizenship in their nation. One such country is St. Kitts & Nevis.

5. Financial Benefits and Tax Reduction

Perhaps one of the most important benefits of a second citizenship is getting access to new financial markets and reducing tax liability.

While Roger Ver says it was not a primary factor in his decision to obtain St. Kitts & Nevis citizenship and renounce his American citizenship, he no longer needs to file income taxes again – of course, if he continues his tax residency in the Caribbean island nation.

As you know, different countries offer different tax systems. Most investors and high-net-worth individuals prefer …

- either territorial tax systems (where foreign-sourced income is not subject to income tax)

- or no income tax at all.

Based on all the factors mentioned in this article, we recommend finding the sweetspot for you and your family. But we do calculate how much you’ll save or owe on your income, capital gains, inheritance, and wealth if you choose to invest in a program.

In most cases, we help our high-net-worth individuals invest in a second citizenship in a tax-friendly country that leads to substantial savings and more wealth accumulation.

For example, consider an entrepreneur primarily based in a country with a high tax burden like Canada. He or she acquires citizenship in and moves their tax residency to Malta, known for its favorable tax policies and strategic location in the Mediterranean.

This move not only expands the entrepreneur’s business reach within the EU, but also offers significant tax relief.

6. Values and Cultural Fit

While not a hugely significant factor if the applicant doesn’t plan to reside in the country, values and culture are an important consideration throughout the citizenship research process.

But if an investor chooses to reside and work in the new country of their citizenship, they should consider whether that nation’s norms and regulations align with their personal beliefs and lifestyle preferences.

Every nation has its unique cultural, social, and political nuances. And for the most part, we individuals are powerless to them.

Choosing a country whose values resonate with yours can lead to a more fulfilling life experience, seamless integration, and a deeper connection with the new homeland.

7. Safety and Security

Especially in a world hellbent on demonizing high-net-worth and ultra-high-net-worth individuals, safety and security are serious factors in the citizenship-by-investment process.

We are closer than ever to World War III. A serious new war – that could bring global powers to the brink – breaks out seemingly every year.

God forbid – Where will you and your family be safest in the event ultimate chaos occurs?

Apart from military involvement, a country’s political stability, crime rates, and overall safety directly affect an individual’s quality of life and peace of mind. This is the exact reason many from North America and Western Europe are pursuing a Plan B: Individuals want to ensure that their new home provides a secure environment for themselves and their families.

Diversifying Your Passport Portfolio

The concept of diversifying your citizenships is similar to investment diversification. Typically, investors want a balance of the best lifestyle, risk minimization, and personal and professional opportunities for themselves and their families.

Once you’re set on the right jurisdiction for you, you must choose an investment path. Depending on the citizenship-by-investment program, you may have a decision to make.

For example, in Portugal, investors have several options for the golden visa residency program, which leads to citizenship after just five years, including:

- Fund subscription

- Capital transfer

- Company creation

- Donation

Which investment path provides the best return-on-investment opportunity for your capital? It’s a personal decision, but be sure to consult the experts.

Successful Passport Portfolios of High Net Worth Individuals

Peter Thiel

Peter Thiel has citizenship-by-birth in Germany, citizenship-by-naturalization in the United States, citizenship-by-exceptional circumstances in New Zealand, and is reportedly in the process of citizenship-by-investment in Malta.

With two European Union-member, American, and unique Kiwi citizenships, Thiel has safeguarded his financial future, protected his assets and family, and secured some of the best global visa-free access we’ve seen in a passport portfolio.

Roger Ver

As mentioned above, Roger Ver (aka Bitcoin Jesus) is a pioneer in the cryptocurrency space.

Ver’s choice of St. Kitts and Nevis citizenship and renunciation of American citizenship aligns with his libertarian values and pursuit of financial freedom.

Elon Musk

Elon Musk has citizenship in his birth country of South Africa, in Canada, and in the United States. Do you think this global travel freedom and access to financial markets has helped him build and grow Tesla, SpaceX, Neuralink, and the Boring Company? We do.

Jim Rogers

While he does not disclose full details on his citizenships, famed investor Jim Rogers has at least American and Singaporean citizenship, highlighting his choice to align with future economic trends.

Heidi Chakos

JH Marlin aided Heidi Chakos, host of YouTube show Crypto Tips, in her acquisition of St. Kitts & Nevis citizenship in 2019.

A Plan B passport portfolio is an exercise in foresight. Considering all their options and the factors that impact their decision, high-net-worth individuals must take seriously this critical investment.

Here are some aspects we recommend contemplating before investing:

- Lifestyle

- Business and investment opportunities

- Global mobility

- Family considerations

- Financial benefits and tax reduction

- Values and culture fit

- Safety and security

For those interested, JH Marlin has worked with the most ultra-high-net-worth individuals in the world to obtain citizenship in several countries around the world. No matter your goals, we likely have experience with the program that fits your investment needs.

A second passport is more than a document. It is often a key to unlocking a world of personal and professional possibilities – a tool for securing your future and that of your family.

If you’re interested in getting started with research, contact us here.